MathShow #025 — Introducing pSTAKE’s BNB Liquid Staking Solution!

Host CICI:

I’m Cici, the host of the math show tonight.

Great pleasure to be here with Mikhil — The lead of pstake. Today we will talk about pStake’s BNB Liquid Staking Solution.

Hi Mikhil, nice to meet you. Please say hi to our audience

Mikhil Pandey:

Yes, so let me start by saying that pSTAKE is a liquid staking protocol that allows you to stake your Proof-of-Stake assets and earn staking rewards on them. In addition to this, pSTAKE unlocks the liquidity of your PoS assets by issuing staked representative tokens against your bonded assets, allowing you to earn DeFi yields on top of staking rewards.

So for a user staking BNB with pSTAKE, you can earn BNB staking rewards but you will also receive a staked representative token (which is stkBNB) that can be used to provide liquidity on DEXes, borrow against it, etc thus giving you the opportunity to generate additional yield on top of your staking rewards.

pSTAKE’s liquid staking solution is currently live on 4 chains, namely BNB chain, Cosmos, Ethereum, and Persistence. Additionally, pSTAKE is in the process of developing liquid staking solutions for other leading assets in the industry.

Host CICI:

pSTAKE’s BNB liquid staking mainnet went live on Aug 8th. Can you explain to us what is pSTAKE’s BNB liquid staking and how it works?

Mikhil Pandey:

Yes, our liquid staking implementation for BNB went live on 8th and you can check out the app here: https://bnb.pstake.finance/

With our BNB liquid staking solution, the goal is to improve the staking experience for BNB holders and BNB chain users.

Here is how it works -

As a BNB holder you can first stake your BNB through pSTAKE. pSTAKE’s BNB liquid staking solution will allow you to stake any non-zero amount of BNB. You will be instantly issued stkBNB which follows an exchange rate model (inspired by the Compound’s cToken model). The value of your stkBNB will keep increasing against BNB as it accrues staking rewards in the background. We have even gone one step further to enable auto-compounding on your BNB staking rewards to allow you to generate the highest yields. You may also be able to unstake your stkBNB and get back more BNB than what you deposited because of the staking rewards generated.

When you perform an unstake transaction on the pSTAKE application, stkBNB deposited by you is burnt. A claim request for an equivalent amount of BNB based on the ongoing exchange rate (c-value) will be created against your wallet. You can then claim the unstaked BNB from the pSTAKE application after 15 days (this allows us to safely undelegate funds from validators). You will stop earning rewards after performing the unstake transaction. Alternatively and most importantly, you can skip the waiting period by swapping your stkBNB for BNB directly from the liquidity pools on DEXs such as PancakeSwap instead of unstaking them.

As a user, it is really simple — you stake BNB after connecting with a wallet of your choice such as Math wallet and the pSTAKE protocol will issue you some stkBNB tokens which you can use in DeFi to generate yield. As long as you have stkBNB, you can redeem back your BNB staked along with more staking rewards.

Host CICI:

What are the rewards for liquid staking BNB?

Mikhil Pandey:

Staking rewards on BNB come from the transaction fees paid by users of the BNB chain and thus vary according to the network activity. Currently this is about ~5.2–5.5%.

They are received for delegating BNB to BNB Chain validators every epoch (24 hours). Validators charge a commission on the rewards before sharing it with their delegators (stakers). In this case, the pSTAKE protocol receives the rewards for its users and delegates them to the top performing validators to increase staking rewards by auto-compounding them for our users.

On top of this — you can supply Liquidity to the stkBNB/BNB pool on Pancakeswap for example and earn very lucrative yields by yield farming. Alternatively, users can also leverage yield farm on Alpaca by depositing stkBNB (and again earning lucrative yields)

Host CICI:

What are the main differences between pSTAKE’s BNB liquid staking solution and traditional staking?

Mikhil Pandey:

Here are some of the key differences between pSTAKE’s liquid staking and traditional staking:

1. Zero staking barrier: Staking directly on the native chain requires a minimum of 1 BNB. However, with pSTAKE, this barrier is removed. Users can stake any non-zero amount of BNB on pSTAKE. The underlying staked BNB are then delegated to a trusted set of secure, high-yield generating validators to optimise user rewards.

2. Instant liquidity & Flexibility: When unstaking their BNB, users have to wait for the 7-day unbonding period before the asset becomes liquid and ready-to-use. However, by staking their BNB via pSTAKE, users receive instant liquidity on their staking position in the form of stkBNB. pSTAKE’s stkBNB will have pools with BNB and other assets in the future, making it easy for users to swap their stkBNB for BNB at anytime, thus bypassing the unbonding period and providing unparalleled flexibility.

3. DeFi Opportunities & Higher Yield: With stkBNB, users have the opportunity to earn higher yields generated across integrated BNB Chain DeFi applications in addition to staking rewards, versus only receiving one passive income stream from traditional staking.

4. Auto-Compounding: With on-chain staking, rewards compounding isn’t available until the total accumulated rewards earned exceeds 1 BNB (i.e. the minimum stake amount). However, pSTAKE allows users to automatically compound their staking yields so that users continue to maximize their capital efficiency completely and seamlessly.

In a nutshell, liquid staking provides a better user experience than traditional staking and is the most capital efficient way of using your PoS assets.

Host CICI:

What projects are you currently planning on integrating within the BNB ecosystem?

Mikhil Pandey:

I am sure a lot of people here would want to know more about this.

So the initial integration plan is pretty straightforward but really critical to the success of pSTAKE.

1. PancakeSwap: We have two liquidity pools that are live on PCS — stkBNB/BNB and PSTAKE/BUSD, this is where users will be able to trade token pairs and/or provide liquidity to earn yield farming rewards and trading fees. Users who stake LP tokens will receive CAKE as a reward.

2. Alpaca Finance: Users are now able to leverage farm the stkBNB/BNB and PSTAKE/BUSD pools on Pancakeswap by depositing stkBNB and borrowing BNB. ALPACA stakers are also be able to receive PSTAKE rewards through pools within its Grazing Range (again depending on the outcome on governance proposals). Currently users on ALPACA are earning upto ~90% APY on the stkBNB-BNB farm and ~700+ APY on the PSTAKE-BUSD farm. You can find more details about these here: https://app.alpacafinance.org/farm

3. Others: Other potential integrations include Venus Protocol (Money Market for stkBNB), Wombat Exchange (BNB & stkBNB swaps via sidepools), Beefy Finance (earning compound interest on stkBNB), and many more. We are still trying to finalize these. https://app.alpacafinance.org/farm

Host CICI:

Thank you for sharing Mikhil. It’s very useful for the audience.

We have some questions selected from our community members here.

1.There’s a lot of scammers and hackers nowadays, I wanna ask how safe and secure our wallets are on your platform? Also, how secure is your staking system?

Mikhil Pandey:

So with respect to protocol security, it goes without saying that this is of the highest priority to us.

The stkBNB smart contracts have already been audited by Peckshield and Halborn. We have had a formal verification by Certora. We are also working with Forta to set up bots for continuous on-chain monitoring of important events.

On top of that, we also launched a bug bounty program with Immunefi to ensure that the protocol is safe from any possible exploits and we have whitehat hackers constantly looking for bugs to help strengthen the protocol.

Peckshield audit report:

Halborn audit report:

To secure your wallets, my only recommendation would be to always ensure you are connecting them to the right app (always check the url before connecting your wallets)

Host CICI:

2.How is your project different from other projects?

Mikhil Pandey:

The direct answer to this question would be

1. Our focus on security

2. Our focus on UX and integrations

The bigger version of this response is — we focus a lot on security, before our products are launched, we do a thorough security check as much as possible. We will continue getting the product audited post launch as well and we will continue working with the best security folks to improve the product.

The second as a highlighted is the UX aspect. We want stkBNB to become the base asset of the BNB chain ecosystem. Which means stkBNB should be integrated with as many dApps as possible and thus be the most preferred version of BNB in the BNB chain ecosystem. These two approaches I think differentiate us with other projects

done!

Host CICI:

3. What’s the roadmap for stkBNB?

Mikhil Pandey:

The roadmap for stkBNB can actually be broken down into short to mid term and a long term roadmap

Short to mid term:

1. Launch of v1 with a strong focus on security. Security audits, strong on-chain monitoring, bug bounty as mentioned above (This is already done)

2. Integrations

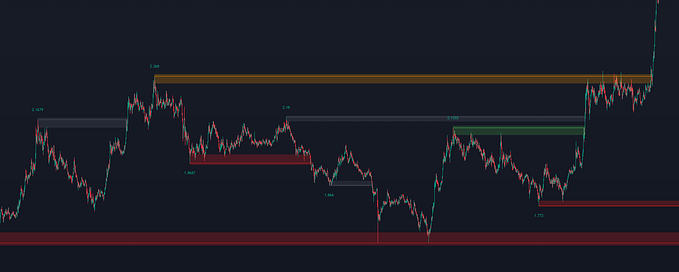

- Decentralised Exchanges — Integrated with Pancakeswap with $7M+ liquidity in the stkBNB/BNB pool

- (Leveraged) yield farming protocols — Integrated with Alpaca with $5M+ liquidity in the farm

- Borrowing/Lending platforms — Coming soon

- Wallet service providers — Integrations with wallets such as Math to allow users to stake with their preferred wallets

3. Launch of v2

- Features to improve the user experience

- Increase decentralisation of the product

- Implement automated delegation and rebalancing strategies to give users the best yields with the highest security

Longer term, we want stkBNB to be integrated with every major Binance ecosystem protocol.

Host CICI:

Why pSTAKE chose to deploy on the BNB chain?

Mikhil Pandey:

BNB chain has one of the largest user base and these users deserve a staking experience that no other protocol can match. At pSTAKE, our goal is to serve as many users as possible and that means, we are always looking to solve problems for chains that have a large user-base.

Even with the market sentiment not being the greatest, In Q2 2022, BNB chain saw an increase in new addresses created on a daily basis. This shows that there are a lot of new participants entering the BNB ecosystem and we wish to serve them all. We believe that the BNB chain will always be one of the most important PoS ecosystems in the industry.

You can follow the latest updates from pSTAKE, here:

Twitter: https://twitter.com/pStakeFinance

Telegram: https://t.me/pstakefinancechat